How does the bitcoin source code define its 21 million cap?

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

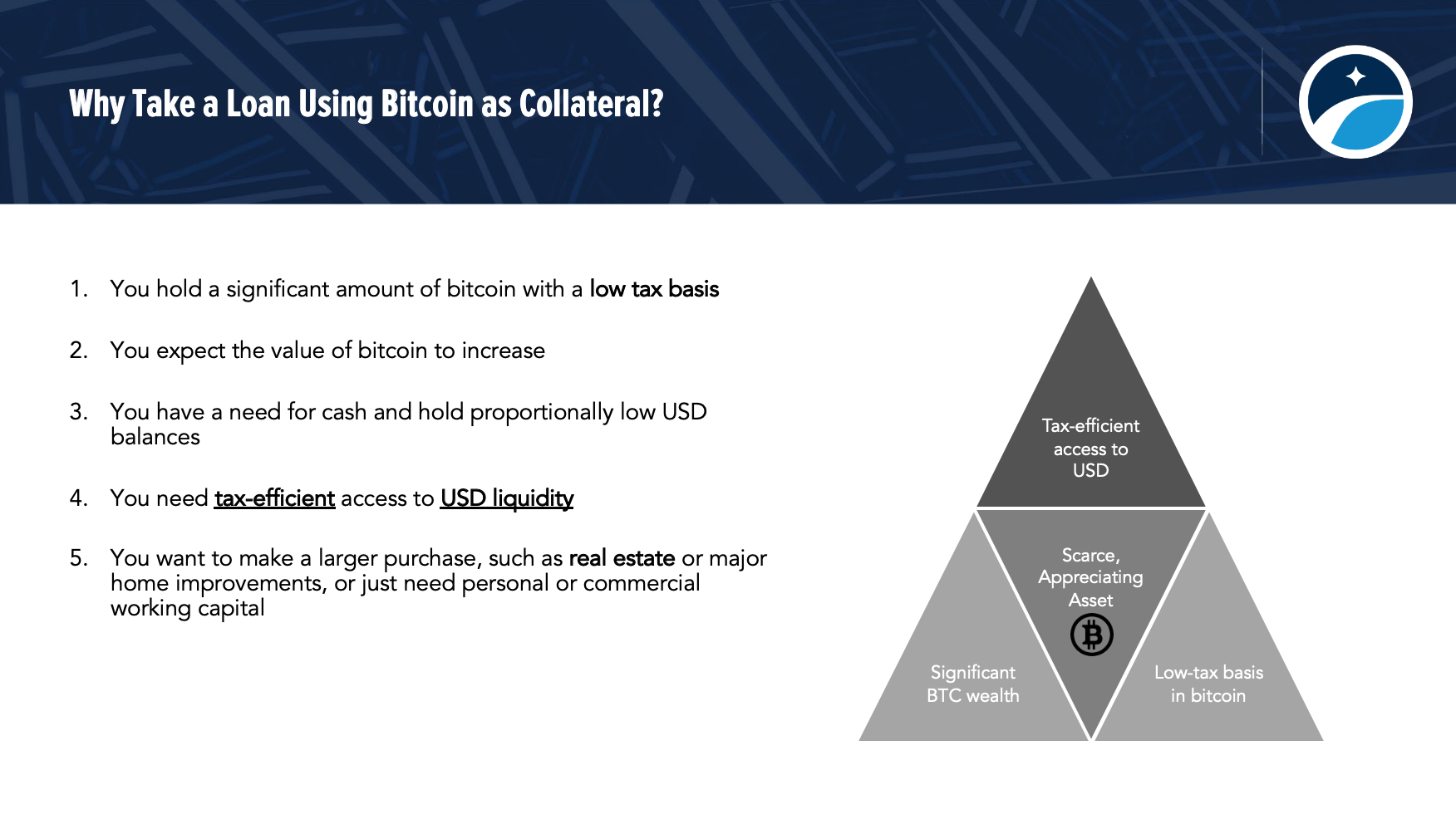

,While you hold bitcoin because you believe it will increase in value, there may come a time when it makes financial sense to access US Dollars using your bitcoin savings. Unfortunately, selling bitcoin in certain countries incurs capital gains taxes. For those looking to avoid selling their bitcoin, bitcoin-backed loans are an option to get dollars today without making a sale.

Bitcoin-backed US dollar loans may be a good option for those who have held bitcoin long-term, have a relatively low tax basis, and need access to dollars. As bitcoin becomes a larger share of an individual’s overall assets, holders may want to improve their lives by accessing the liquidity from bitcoin gains. Unfortunately, much of the legacy financial system still does not recognize bitcoin as a viable asset for many financial services. This is where Unchained can assist with a bitcoin-backed loan.

Unchained began issuing bitcoin-backed loans in 2017. These loans allow bitcoin holders to use their bitcoin as collateral to take out a loan in U.S. dollars, without missing out on the potential long-term gains of holding bitcoin.

In this article, we’d like to share some information about how bitcoin-backed loans work and who should use them. We’ll also address common questions or misunderstandings.

A bitcoin-backed loan is a US Dollar loan collateralized by bitcoin. At Unchained, this involves sending bitcoin to a dedicated multisignature address. Once the bitcoin deposit is confirmed on the blockchain, US Dollars are sent to a client’s bank account and interest on the loan is paid at regular intervals.

Bitcoin-backed loans are similar to traditional secured loans except they use bitcoin as collateral and eliminate the need for credit checks. To set up a loan, you create an account, complete onboarding, upload a key, and submit a loan application. We provide you with loan agreements, and once they are signed, we provide you with a bitcoin address for depositing the loan collateral. You send your bitcoin to the address provided. Once we confirm receipt, we fund your loan by disbursing US dollars to your bank account on the loan’s start date. Interest payments are due every 30 days until loan maturity, where the final interest payment plus the principal loan amount is due. Applications are generally reviewed within 2-3 business days.

Here are a few important factors to consider before taking out a bitcoin loan.

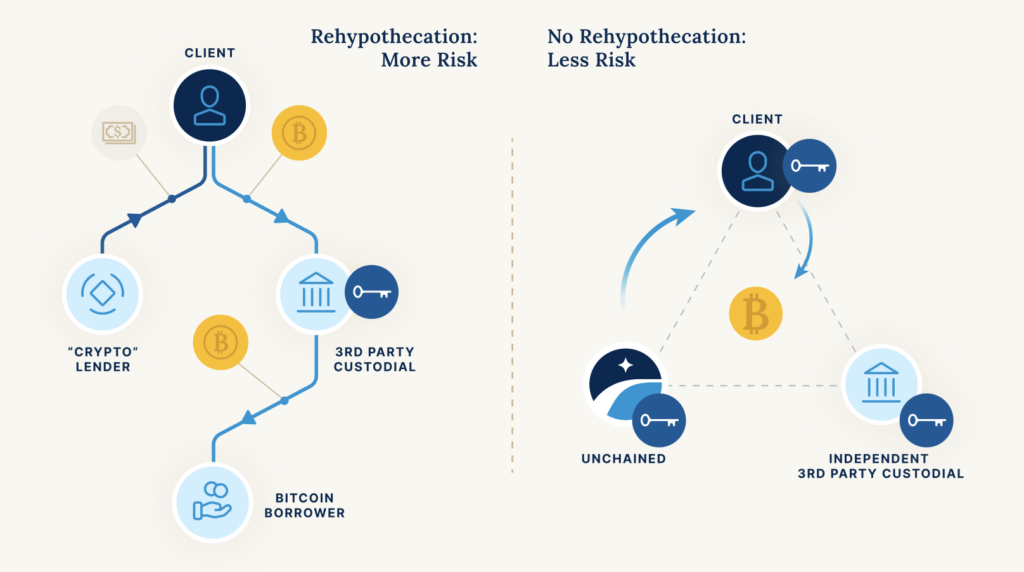

Bitcoin is a “bearer instrument.” Whoever controls the private keys to the bitcoin, controls that bitcoin. As many exchange hacks over the years have taught us, there is no guarantee that a custodian won’t lose your bitcoin.

This means it is extremely important to understand where and how your bitcoin is stored. Be sure to ask any bitcoin-backed loan provider how the bitcoin will be secured.

At Unchained, we believe you should have the maximum control and transparency possible. When you take out a loan, you hold 1 of 3 keys, which you can use to confirm that your assets are segregated in a dedicated multisignature address. This also means that Unchained is unable to lend out your collateral to others for additional yield (a process commonly referred to as rehypothecation).

In this way, we minimize the counterparty risk for the custody of your bitcoin and eliminate the possibility of socialized losses, which is a common occurrence for losses from rehypothecated trades.

Here’s how Unchained custody works:

Unchained’s multi-institution 2-of-3 model significantly enhances security for all involved. No one person or organization can threaten the collateral. This provides enhanced controls for several scenarios:

Rehypothecation is a practice where banks and brokers lend client assets that have been posted as collateral. By doing so, client assets are put at risk and the bank (or broker) earns interest by re-lending client assets. In the case of bitcoin-backed loans, many loan providers take their clients’ bitcoin, which serves as collateral to a dollar denominated loan, and lend those assets out to third parties.

As a part of this process, the bitcoin loan provider is earning interest from both the interest payments of the borrower and the proceeds of lending the borrower’s collateral to others. The lender will often pass a portion of this interest on to the borrower of dollars in the form of a marginally lower rate of interest, but all or a portion of the borrower’s collateral has been put at risk. Many borrowers are unaware of this, and it is rarely discussed or disclosed prominently. Through rehypothecation of collateral, a borrower of dollars is being exposed to multiple layers of counterparty risk.

Working with a lender that is rehypothecating the bitcoin used as collateral means putting your bitcoin at risk. Ultimately, you should make an assessment of not only the credit risk of the lender but also the credit risk of the borrowers to which the lender is lending the rehypothecated collateral. By using a lender who rehypothecates collateral, you are accepting the risk that either the lender or the borrower of rehypothecated collateral becomes insolvent, leading, most likely, to socialized losses for all borrowers with a loan from the lender.

At Unchained, we do not rehypothecate collateral, eliminating this risk. Further, we allow you to hold 1 of the 3 keys to your collateral address, which gives you the ability to prove cryptographically that your bitcoin is stored in a dedicated address at all times and has not been rehypothecated.

A key reason borrowers take loans from Unchained is to preserve their bitcoin. The structure and security of our loans minimizes counterparty risk and prevents any potential losses from being socialized.

When bitcoin lending companies rehypothecate, they often pool client funds and lend them out to short sellers and market makers. If a trade leads to losses, in many cases, all clients will be affected, since the bitcoin has been pooled.

Unchained provides borrowers assurance that their collateral is secure and auditable on-chain. Our rates may seem higher, but our rates are usually lower when adjusting for risk.

If bitcoin is the future global reserve currency, why would it make sense to cut corners to save a small amount on the interest? The risk of losing your bitcoin forever is far too great. If bitcoin is ever re-lent through rehypothecation arrangements, the risk of principal loss is much greater. If preserving your bitcoin is a reason for using a loan rather than just selling, taking that risk defeats the purpose of the loan.

Unchained generally lends at 40% LTV. Unlike many other companies, since we do not rehypothecate, we are less sensitive to collateral increases. For lenders that do rehypothecate, higher LTV rates of 50% or 60% represent additional bitcoin that can be lent out to achieve a higher return. So, such lenders put more borrower bitcoin at risk via rehypothecation.

At Unchained, our most important considerations are maintaining our client relationships and securing our clients’ bitcoin. With this focus, we’ve never been tempted to increase our clients’ risk to improve our profits or lower our rates. We believe we’ve made the correct decision for our loan product: no rehypothecation and a serious dedication to security.

Many bitcoin companies advertise that bitcoin collateral is insured. There are a few questions to ask a loan provider to identify what is exactly covered by insurance. Since bitcoin is a bearer asset and transactions are irreversible, insurance can be very tricky and often doesn’t provide adequate coverage. Holding private keys is generally the best insurance in bitcoin.

These questions are extremely important to ask and are usually not covered adequately by insurance. A new asset like bitcoin comes with an entirely new security paradigm that can’t be duplicated using the same tools from the existing system, which is why Unchained believes that private key ownership is the safest way to offer financial services.

For bitcoin-backed loans, origination fees are the fees paid to initiate the loan. This is a one-time fee that is paid up front and deducted from the principal loan amount before a disbursement is sent to the borrower. At Unchained, the origination fee depends on the duration of the loan.

Some lenders will add an origination fee on top of the loan amount. For example, using $10,000 as a principal loan amount requested, they will deposit $10,000 into the client’s bank account and charge them a $100 origination fee. In this case, the principal loan amount will be $10,100. Other lenders, such as Unchained, deduct the origination fee from the principal loan amount requested, meaning if a client requests $10,000, $9,900 is deposited into their bank account and the $100 origination fee is deducted from the amount requested.

The APR is the total cost of the loan expressed as an annual rate, and the formula in the United States is mandated by the Truth in Lending Act. Below is an example of how the term, interest rate, origination fee, and principal are used to determine the APR of a loan in the United States. Note the below interest rates, origination fees, and APRs are by way of example only and do not reflect Unchained’s actual current interest rates and fees.

| Term in Month | Interest Rate | Origination Fee | Principal | APR | Total Cost of the Loan if held for 1 year |

| 3 | 12% | 1% | $10,000 | 16.16% | $1,631.86 |

| 6 | 12% | 1% | $10,000 | 14.11% | $1397.44 |

| 12 | 12% | 1% | $10,000 | 13.02% | $1283.56 |

The APR annualizes the total cost of a loan, including fees, with the intention of making side-by-side loan comparisons easier. In the example above, the 3-month loan would have been renewed 3 times. The total cost is higher than the 12-month loan because the origination fee must be paid each time a borrower chooses to renew.

Many lending companies will offer a lower interest rate but a higher origination fee. As demonstrated below, this causes the APR to increase substantially and ultimately means the loans are more expensive for the borrower in scenarios where multiple loans originate in the same year.

| Term in Month | Interest Rate | Origination Fee | Principal | APR | Total Cost of the Loan if held for 1 year |

| 3 | 11% | 2% | $10,000 | 19.37% | $1970.39 |

| 6 | 11% | 2% | $10,000 | 15.23% | $1506.93 |

| 12 | 11% | 2% | $10,000 | 13.10% | $1284.93 |

Shorter term loans will advertise lower interest rates, but keep in mind the origination fee. If a client were to take a 3-month loan with a 1% origination fee, and then the client chose to renew the loan, the client could end up spending more annually than if they were to take a 12-month loan at a slightly higher interest rate with a single origination fee.

The loan to value requirement is an important metric to consider when taking a bitcoin-backed loan. At 40% LTV, this means that a $10,000 loan requires $25,000 of bitcoin used as collateral. This ratio helps prevent collateral liquidations during normal market price fluctuations.

Companies may offer lower interest rates at lower LTV ratios (eg 20%, 30%). This means that their clients are depositing far more bitcoin. Some companies do this so they can then rehypothecate (lend out) the collateral to those interested in borrowing bitcoin, and other companies ask for lower LTV because it is lower risk for the companies to lend since they have more collateral. Unchained loans are issued at 40% LTV because we do not rehypothecate, and we want to avoid liquidations as much as possible. Rate reductions may be available for a lower LTV at origination.

The collateral to principal ratio is the inverse of the loan to value ratio. A 40% LTV means that you have a CTP of 250%. The CTP ratio makes it easier for Unchained clients to understand the current status of their collateral ratio, especially during a drop in the price of bitcoin.

Many traditional loans contain prepayment penalties, meaning that clients incur a charge for repaying a loan before the maturity date.

Unchained loans are allowed to be prepaid without penalty, so clients are free to pay off loans early at no additional cost. If clients repay the loan early, the only cost incurred for the loan will be the origination fee plus interest for the period during which the funds were utilized and outstanding as a balance of principal. Once the principal balance has been repaid, the remaining interest payments are voided and the rest of the collateral will be returned.

Many bitcoin lending companies have created their own currency, which can be used to make interest payments or used as interest payments when customers lend them other currencies, such as bitcoin or stablecoins. To end users, this generally looks like a good deal, as the interest they pay is lower, and the interest they earn is higher for lending out bitcoin. This system is possible for a few reasons.

All of these reasons appear beneficial on the surface, but they are hiding the risks associated with lending out bitcoin or taking a loan in bitcoin.

This system works well until it doesn’t. If the value of their token crashes, clients can be left holding less valuable tokens while their bitcoin has been lost. Remember: Not your keys, not your bitcoin.

Unchained does not provide tax, legal or accounting advice. Due to the complexity of tax law and changing legislation, you should consult with your tax professional regarding your specific circumstance. The information contained below is for informational purposes only and does not constitute tax advice.

In traditional lending, if using an asset like a home as collateral for a loan, the IRS does not claim that the asset has been “sold,” so the home owners are not subject to capital gains that a sale might trigger.

Taking out a loan is usually “tax neutral” with respect to the collateral. Even if the value of the home has increased, using it as collateral for a loan is not a “sale,” and therefore clients are not required to pay capital gains taxes at the time of the loan.

In the crypto lending space, the IRS has not given explicit guidance, but the treatment of crypto-backed loans will likely be analogous to traditional lending. In March 2014, the IRS stated that virtual currencies should be treated as property for tax purposes.

As with traditional lending, the use of property as collateral should not be considered a sale. Therefore, borrowing against cryptocurrency should not trigger capital gains taxes.

The IRS has yet to issue specific guidance surrounding interest payments in crypto lending. However, we can begin to get a better idea for how they may be treated by once again looking at traditional lending. To understand whether interest payments are tax-deductible, it is necessary to consider whether a loan is used for personal, investment, or business-related purposes.

If a business takes out a loan for a commercial purpose, the interest is typically treated as a legitimate tax-deductible business expense.

If a loan is taken out for personal reasons, interest expense is usually not considered tax-deductible. However, if an individual borrows money to purchase a piece of real estate that will produce investment income, the interest they pay on their loan may be considered investment interest expense, which may be tax-deductible.

For more information on whether an investment interest expense is tax deductible, you should consult with a tax professional or look at this article.

During a margin call, borrowers can choose to either deposit additional collateral or pay down their principal to re-adjust their collateral-to-principal ratio to required levels.

In the rare case of a liquidation event, which occurs when a borrower has not been able to satisfy the margin call with a deposit of collateral and/or principal payment and/or the value of their bitcoin collateral falls to a collateral-to-principal ratio of 110%, Unchained would be forced to foreclose and sell bitcoin on behalf of the borrower to recover the amount owed on the loan.

This would be treated as a property sale for income tax purposes, and clients may be liable for capital gains tax based on the sale price (and value).

At the end of the term of the loan, a few options are available to pay off the loan.

One consideration for a refinance is the LTV may have risen beyond 40% over the existing loan term. If the bitcoin price has decreased, then additional collateral may be required for a refinance.

Some lenders allow excess collateral to be redeemed to an address which is fully under a client’s control.

If the bitcoin price increases so that the CTP ratio exceeds 300%, the borrower can withdraw collateral until the CTP ratio is back to the original 250%. Collateral refunds are supported once every 30 days or 30 days since the previous margin call, although it is a good practice to keep extra collateral in the event that the price of bitcoin drops. The borrower can move the refunded bitcoin into a multisignature vault address where they hold 2-of-3 keys, or into another bitcoin address of their choosing.

Bitcoin is a volatile asset, so the CTP of a loan constantly fluctuates. Lenders set loan terms to adjust for these price fluctuations, but at some point, if the price of bitcoin drops too far, borrowers will need to post additional collateral or pay off part of the loan’s principal as part of a margin call. A margin call means that action must be taken in order to get the loan back to a required collateral position.

For an Unchained loan, the margin call process begins at 150% CTP. In the event the CTP ratio of a loan hits 150%, borrowers must either deposit additional bitcoin collateral or fund a partial repayment of the loan principal to improve the CTP ratio.

If the price of bitcoin drops further and causes the loan to decrease to a CTP ratio of 135%, the time to respond to the margin call is accelerated. Borrowers then have 4 hours to either deposit additional bitcoin collateral or fund a partial repayment of the loan principal to improve the CTP ratio.

Finally, in the most extreme bitcoin price drops, Unchained must immediately liquidate loans at 110% CTP. This is the worst case scenario, but we must follow this rule without exception to ensure that Unchained can continue to lend to clients in the future.

Traditional banking limitations can cause delayed deposits, particularly when trying to make principal payments over holidays and weekends or after traditional banking hours. The ability to respond by sending bitcoin collateral is the best way to respond when traditional banking is unavailable.

We never want to see loans liquidated, so we do our best to work with clients through the margin call process by presenting options to maintain the CTP ratio at required levels. An Unchained Vault provides an easy option to transfer bitcoin quickly into a loan collateral address during margin calls.

Getting a loan allows clients to access dollars from their bitcoin today without having to sell and incur capital gains tax or reduce exposure to bitcoin price increases. Taking a loan during a bitcoin bull market can be a good way to access dollars without missing the gains from bitcoin’s increase in value.

Here are some of the most common reasons people take out bitcoin-backed loans.

Many long-term bitcoin holders want to diversify their portfolios into real estate. Investors may be considering buying a home to use personally or as a cash flow rental property. Similarly, existing real estate owners may want to remodel or to make improvements to existing properties.

However, a significant tax liability or desire to hold a long-term bitcoin position may prevent one from cashing out. A bitcoin loan is an option to get access to cash needed for a real estate purchase without missing out on future appreciation.

Many bitcoin investors are also entrepreneurs and small business owners.

A strategic loan on bitcoin holdings can allow corporations to

A strategic business loan paired with a client-controlled vault gives a business total control over their BTC, and flexibility with how they leverage company holdings. With Unchained business, you get access to accounting documents to track your bitcoin flow, multiple users with different permissions, the ability to purchase bitcoin OTC, and quick access to USD.

Unchained is the only bitcoin-native financial services company that gives businesses and individuals control over private keys, which is why our business suite delivers the highest level of security in the industry.

Businesses also deserve to hold their private keys and to have access to financial services, but the needs of a business are different than the needs of an individual.

Why would I take a bitcoin loan instead of selling my bitcoin?

To answer this question, we consulted with Daniel Winters of Global Tax, LLC.

“Crypto investors have unique challenges concerning their taxes, especially long time investors that have large paper gains. For an early investor interested in generating USD from their assets, selling it at the long term capital gains rate seems an obvious choice.

However, that’s not always the best decision. At higher income levels, the federal long term capital gains rate is 20%, plus an additional 3.8% for a total of 23.8%. When you add state income taxes, the total tax hit can easily reach 30% or higher. In this scenario, an investor with $1,000,000 in long term capital gains may end up with only $700,000 after taxes. In essence, the investor has a 30% cost of capital to cash out to USD.

If appropriate tax planning isn’t done, the investor may actually need to sell additional crypto assets to cover the USD taxes due on the original capital gain. Now, the investor has even more tax to pay, because they have new capital gains from selling crypto to pay the taxes on the original sale.

One alternative is taking out a bitcoin-backed loan. Borrowing against crypto assets is usually NOT a sale, thus no tax is usually due on the transaction. The investor can therefore potentially borrow USD against their crypto, continue to hold their bitcoin, and pay less in interest than the taxes on the capital gains.”

Bitcoin mining is extremely resource intensive, demanding large electricity purchases, equipment purchases and constant equipment maintenance. These expenses typically must be paid in a fiat currency. As a result, miners sell much of the freshly mined bitcoin to cover these costs.

Bitcoin loans offer an alternative to selling bitcoin to cover these expenses. With a collateralized loan, miners can access the dollars they need to cover their costs, while still capturing the gains from the bitcoin that they earned.

A bitcoin loan combined with other financial services, such as bitcoin custody, buying and selling and futures contracts, give miners many different options to hedge risks if the mining landscape becomes more competitive, or if the price of bitcoin crashes making it temporarily unprofitable to mine.

Increasing the number of available derivative markets and financial options for miners helps to grow the bitcoin ecosystem by allowing the mining industry to weather short-term shocks.

With an Unchained business account, mining companies can secure their own bitcoin in a 2-of-3 multisignature address where they hold a majority of the keys, can make OTC bitcoin trades, and can access USD using their bitcoin as collateral. Unchained is becoming the one-stop shop for bitcoin-native financial services.

We hope that this guide has answered your most pertinent questions about bitcoin loans. It has been a pleasure to serve the bitcoin community for their custody and lending needs, and we look forward to assisting more bitcoiners on their journey in the future.

Our team of loan experts is happy to help with any additional questions you may have. You can schedule a time to speak with our loans team, or create an Unchained Capital account and apply for a loan today.

Unchained Capital, Inc. is not a bank. Loans may be originated by Lead Bank and subject to approval. Rates and fees vary by term lengths between 90 and 360 days. All loans have a maximum loan-to-value ratio based on required bitcoin collateral. Fees may be assessed on overdue amounts. A loan application is required. May not be available in all states and may be subject to local restrictions where available. California loans may be made or arranged by Unchained pursuant to a California Financing Law license. To learn more about Unchained’s licensing, see our legal and regulatory page.

Lead Bank is an FDIC insured Missouri state-charted bank. Lead Bank is an equal opportunity lender.

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

Ted Stevenot, Stephen HallWhen Satoshi Nakamoto created bitcoin, he established in its code a fixed number of bitcoin that will ever exist. Since…

Ted StevenotOriginally published in Parker’s dedicated Gradually, Then Suddenly publication. Bitcoin is often described as a hedge, or more specifically, a…

Parker Lewis