How does the bitcoin source code define its 21 million cap?

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

,

If one thing is certain, it is that bitcoin is humbling. It humbles everyone. Some sooner than others, but everyone eventually. Individuals you respect may have called bitcoin a fraud or compared it to rat poison but if it hasn’t been walked back yet, it will in time. For most everyone first considering bitcoin, the reality is that the proper context to evaluate it is practically non-existent, even for the most revered financiers of our time. Is bitcoin like a stock, bond, tech startup, the internet or merely a figment of everyone’s imagination? At first glance, bitcoin admittedly makes very little sense. It is very reasonably believed by many to be one massive collective hallucination. There exist two fundamental problems. Almost everyone lacks the baseline to evaluate bitcoin because there has never been anything like it, and very few, prior to bitcoin, have ever consciously considered what money is. Every day, people evaluate whether to invest in stocks, bonds or real estate, or whether or not to buy a home or car, or whether to purchase some consumer good, or conversely, whether to save. While there are exceptions to every rule, practically everyone is unequipped to evaluate bitcoin because it does not fit any prior mental framework. It is like asking someone with no concept of mathematics what 2 + 2 equals. It may be obvious to those that know math, but if not, it’s unrelatable. To make it even more difficult, bitcoin is so abstract an application and so far from a tangible phenomenon, that it is like staring into the abyss. Bitcoin is both difficult to see and impossible to unsee once discovered. But often the path from one end of the extreme to the other is a journey, where the impossible first becomes possible, then probable and ultimately inevitable.

Eventually, some chord is struck or some dot connected. As the fog begins to lift, there naturally remains the idea that, while bitcoin is possible, it is surely subject to high degrees of chance and more likely to fail than succeed. It is perceived to be inherently fragile and risky. Many believe that bitcoin could vanish as quickly as it appeared on scene. At the beginning of the journey, it seems to live somewhere between an aspiring long-shot and just one unidentified silver bullet away from complete and utter collapse. Bitcoin is novel and it is often thought of as untested and unproven. Launched in 2009, bitcoin seemingly lacks permanence. It is not yet anchored in time. But on the other hand, bitcoin has been around for going on twelve years and has a total purchasing power (or value) of $180 billion. Twelve years of operating history and hundreds of billions in value may still be an upstart, but it is far from untested and unproven. Instead, it is thriving in the wild without any central coordination, and it is the lack of central coordination that gives bitcoin its lifeblood; decentralization not only allows bitcoin to function, but it is also what causes it to gain strength rather than falter when stressed.

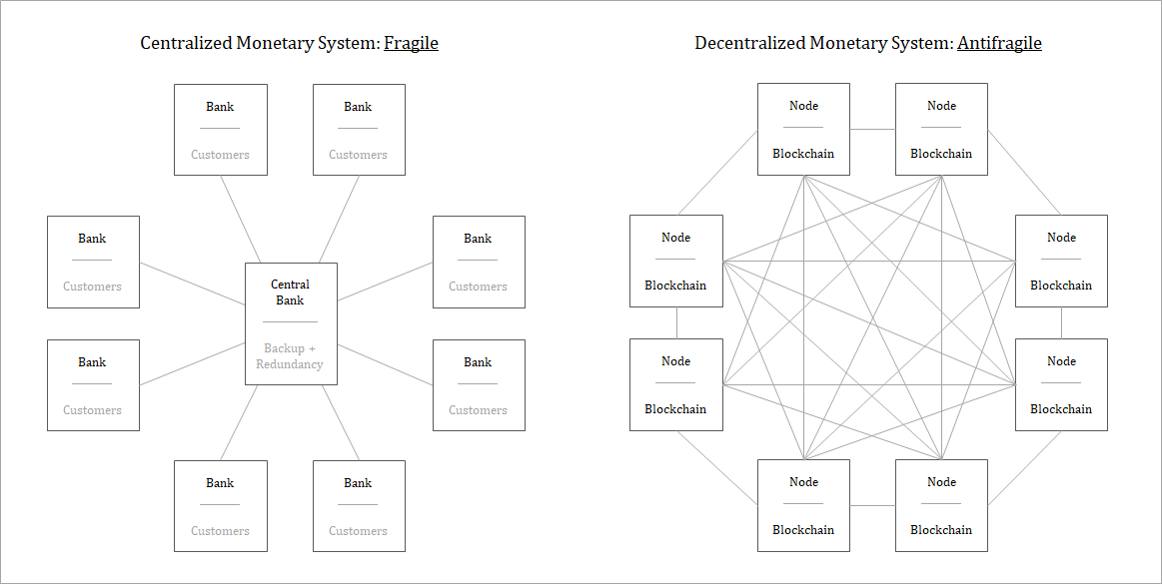

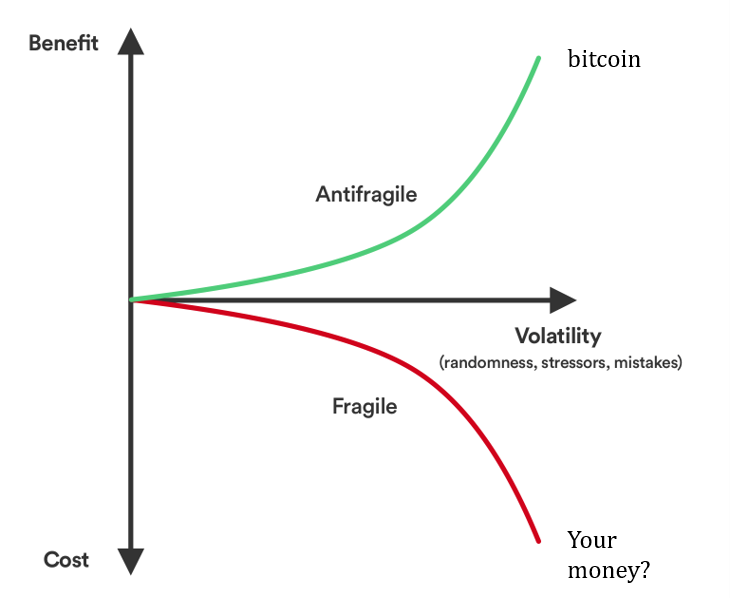

That bitcoin is natively digital and powered by computers running software capable of being shut down lends to the default impression that bitcoin is inherently fragile. The mental image of a computer network being unplugged creates the false sense that one day and suddenly, somehow bitcoin as a system could cease to exist when the opposite is true for the very same reason. That bitcoin both exists everywhere and nowhere, that it is controlled by no one, that anyone is capable of running the open source software from anywhere, and that hundreds of thousands of people do, relied upon by tens of millions (and growing) is what gives bitcoin permanence. With no single point of failure, bitcoin is practically impossible to stop because it is impossible to control, and it is a dynamic system that only becomes more redundant and further decentralized in time and with increasing adoption. In short, bitcoin is more permanent than risky because it is an antifragile system. An idea popularized by Nassim Taleb, antifragility describes systems or phenomena that gain strength from disorder, which is bitcoin to its core. There is no silver-bullet that kills bitcoin; there is no competitor that can magically overtake it; there is no government that can shut it down. But it does not stop there; each attack vector and shock to the system actually causes bitcoin to become stronger.

“Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure, risk, and uncertainty. Yet, in spite of the ubiquity of the phenomenon, there is no word for the exact opposite of fragile. Let us call it antifragile. Antifragility is beyond resilience or robustness. The resilient resists shocks and stays the same; the antifragile gets better. This property is behind everything that has changed with time: evolution, culture, ideas, revolutions, political systems, technological innovation, cultural and economic success, corporate survival, good recipes (say, chicken soup or steak tartare with a drop of cognac), the rise of cities, cultures, legal systems, equatorial forests, bacterial resistance … even our own existence as a species on this planet. And antifragility determines the boundary between what is living and organic (or complex), say, the human body, and what is inert, say, a physical object like the stapler on your desk. […] The antifragile loves randomness and uncertainty, which also means—crucially—a love of errors, a certain class of errors.” – Nassim Taleb, Antifragile

Bitcoin is an adaptive and evolving system; it is not static. No one controls the network and there are no leaders capable of forcing changes onto the network. It is decentralized at every layer, and as a result, it has shown to be immune to any type of attack. However, it is not just immune to attack or errors, bitcoin actually becomes stronger as: i) external forces attempt to influence or coopt the network; ii) as individuals within the network make errors; and, iii) as a very function of its volatility, which is often perceived to be a limiting, if not critical, flaw. As bitcoin survives shocks and as individuals learn from errors and adapt to its volatility, bitcoin becomes tangibly more reliable; its demonstration of resilience and immunity causes trust to be reinforced in the network, which increases adoption and makes bitcoin more resistant to future attack or individual errors. It is a positive, self-reinforcing feedback loop. With every failed attempt to coopt or coerce the network, the bitcoin protocol hardens and confidence increases. Every time bitcoin doesn’t die, that very event propels bitcoin forward, and in a fundamentally stronger state than previously existed.

Each exogenous shock to the network provides learnings that cause bitcoin to adapt in a spontaneous way, which can only be endemic to a decentralized system. Because bitcoin is decentralized and because it becomes increasingly decentralized as a function of time (and adoption), not only is there no single point of failure, but the increasing levels of redundancy ensure network survival and fortify it against future attacks. There is a positive correlation between time and the degree of network decentralization. Similarly, there is a positive correlation between the degree of decentralization and the network’s ability to fend off more formidable attacks. Essentially, as the network becomes more decentralized over time, it also becomes resistant to threats it may not have been capable of surviving in prior states.

Separately, each error within the system is isolated to the responsible parties, and as bitcoin grows, each potential point of failure becomes less critical to the proper functioning of the network as a whole. Weak points in the network are sacrificed and the system strengthens in aggregate. The entire process is made more effective and efficient because it is never a conscious decision. It is simply structural to the system architecture. No one picks winners and losers. Decentralization eliminates moral hazard and ensures system survival at the same time. At all times, network participants are maximally accountable for their own errors. There are no bailouts. Incentives and accountability optimize for innovation and naturally drive toward consistently better outcomes in aggregate. It doesn’t eliminate error, but it ensures that errors are productive, as the mere fact of survival affords that the network as a whole has the opportunity to adapt to threats and to immunize around them. Whether borne from exogenous shocks or internal errors, bitcoin feeds on disorder, stressors, volatility and randomness, collectively a hallmark of an antifragile system.

The lack of social order in bitcoin may be its single greatest asset. There is no CEO of bitcoin nor is there a centralized authority that controls it. There is no person or organization to drag in front of Congress, whether to answer questions or demand action. In fact, there is no Congress or legislative body with any influence over bitcoin, preferential or otherwise. It does not mean that any individual or company is immune from influence; nor does it prevent any country from attempting to regulate (or ban) bitcoin, but disorder insulates the network from external threats. While Facebook’s Libra is fundamentally plagued as a currency for reasons independent of government influence, the CEO and other top executives were quickly brought before Congress soon after its announcement to answer questions and with key legislators demanding the project be delayed, if not scrapped, over concerns of “national security” and other regulatory issues. It is not that CEOs and companies cannot coexist with government; instead, it is that the mere existence creates influence that could never exist in bitcoin at a protocol level, and the absence of which allows bitcoin to be viable as a currency.

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.” – Satoshi Nakamoto (February 11th, 2009)

With no central counterparties controlling the network, bitcoin functions on a decentralized basis and in a state that eliminates the need for, and dependence on, trust. Its distributed architecture reduces the network’s attack surface by eliminating central points of failure that would otherwise expose the system to critical risk. By being built on a foundation of social disorder and only in the absence of control is bitcoin able to function on a secure basis. It is the precise opposite of the trust-based central bank model. Bitcoin is a monetary system built on a market consensus mechanism, rather than centralized control. There are certain consensus rules that govern the network. Each participant opts in voluntarily and everyone can independently verify (and enforce) that the rules are being followed. If any market participant changes a rule that is inconsistent with the rest of the network, that participant falls out of consensus. The network consensus rules ultimately define what is and what is not a bitcoin, and because each participant is capable of enforcing the rules independently, it is the aggregate function of enforcement on a decentralized basis that ensures there will only ever be 21 million bitcoin. By eliminating trust in centralized counterparties, all network participants are able to rely upon and ultimately trust that the monetary policy is secure and that it will not be subject to arbitrary change. It may seem like a paradox but it is perfectly rational. The system is trusted because it is trustless and it would not be trustless without high degrees of social disorder. Ultimately, a spontaneous order emerges out of disorder and strengthens as each exogenous system shock is absorbed.

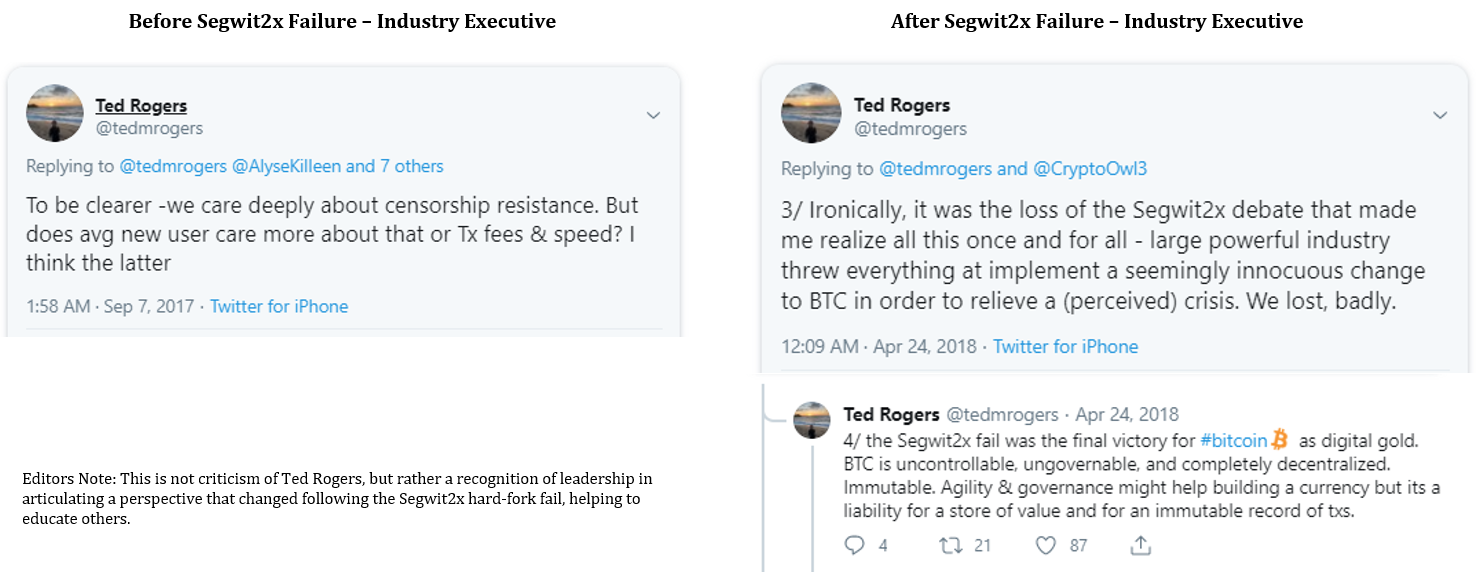

For example, in 2017, there was a civil war of sorts that emerged in bitcoin. Many of the largest companies that provide bitcoin custody and exchange services aligned with large bitcoin miners that controlled 85%+ of the network’s mining capacity (or hash rate) in an attempt to force a change to the consensus rules. This group of power brokers wanted to double the bitcoin block size as a means to increase the network’s transaction capacity. However, an increase to the block size would have required a change to the network consensus rules, which would have split (or hard-forked) the network. As part of a negotiated “agreement,” the group proposed to activate a significant network upgrade (referred to as Segwit – an upgrade that would not change the consensus rules) at the same time the block size would be doubled (which would have changed the consensus rules). With most all large service providers and miners onboard, plans were set in motion to effect the changes. However, a curve ball was thrown when a user-led effort prompted the activation of the Segwit network upgrade without changing the network consensus rules and without increasing the block size (read more here). The effort to change the network’s consensus rules failed miserably and bitcoin steadily marched forward undisturbed. In practice, it often cannot be known whether bitcoin is resistant to various threats until the threats present themselves. In this case, it was disorder that prevented coordinated forces from influencing the network, and at the same time, everyone learned the extent to which bitcoin was resistant to censorship, which further strengthened the network.

This episode in bitcoin’s history demonstrated that no one was in control of the network. Not even the most powerful companies and miners, practically all aligned, could change bitcoin. It was an incontrovertible demonstration of the network’s resistance to censorship. It may have seemed like an inconsequential change. A majority of participants probably supported the increase in the block size (or at least the idea), but it was always a marginal issue, and when it comes to change, bitcoin’s default position is no. Only an overwhelming majority of all participants (naturally with competing priorities) can change the network’s consensus rules. And it really was never a debate about block size or transaction capacity. What was at stake was whether or not bitcoin was sufficiently decentralized to prevent external and powerful forces from influencing the network and changing the consensus rules. See, it’s a slippery slope. If bitcoin were susceptible to change by the dictate of a few centralized companies and miners, it would have established that bitcoin were censorable. And if bitcoin were censorable, then all bets would be off. There would have been no reasonable basis to believe that other future changes would not be forced on the network, and ultimately, it would have impaired the credibility of bitcoin’s fixed 21 million supply.

That the most powerful players in bitcoin could not influence the network reinforced its viability, and it was only possible because of the disorder inherent to the system itself. It was impossible to collude or to coopt the network because of decentralization. And it did not just show bitcoin to be resilient, the failure itself made the network stronger. It educated the entire network on the importance of censorship resistance and demonstrated just how uncensorable bitcoin had become. It also informs future behavior as the economic costs and consequences are both real and permanent. Resources to support the effort turned into sunk costs, reputations were damaged, and costly trades were made. All said, confidence in bitcoin increased as a function of the failed attempts to control the network, and confidence is not just a passive descriptor. It dissuades future attempts to coopt the network and drives adoption. Increasing adoption further decentralizes the network, making it even more resistant to censorship and outside influence. It may seem like chaos, but really, social disorder was and will continue to be an asset that secures the network from unpredictable and undesired change.

Attempts to influence the network consensus rules may be the most acute stressor, as it is these rules that underpin the entire system and create order out of disorder, but bitcoin is consistently exposed to a myriad of smaller stressors that similarly strengthen the network as a whole and over time. There are many different forms of stress, but because bitcoin is exposed to stress on a consistent basis and of a wide variety, it forces the network to constantly adapt and evolve while also building its immune system from the outside in.

| Type of Stressor | Example | Impact / Outcome |

| Consensus Rules | – Segwit2x Civil War – Bitcoin Cash Hard-Fork | – Bitcoin proves to be censorship resistant – Bitcoin wins, strengthens |

| Government action | – Indian central bank banning banks ability to service bitcoin companies – China clamping down on exchanges and mining activities – U.S. Congress representatives calling for bans or restrictions – Bitcoin addresses being put on OFAC list | – Network continues to function uninterrupted – Network adapts and immunizes threat – Bitcoin wins, strengthens |

| Competing protocols | – Bitcoin hard forks and copies – World Computer – Utility Tokens – Stablecoins – Facebook’s Libra | – Competing currencies fail – Bitcoin remains dominant – Market tests provide information – Bitcoin wins, strengthens |

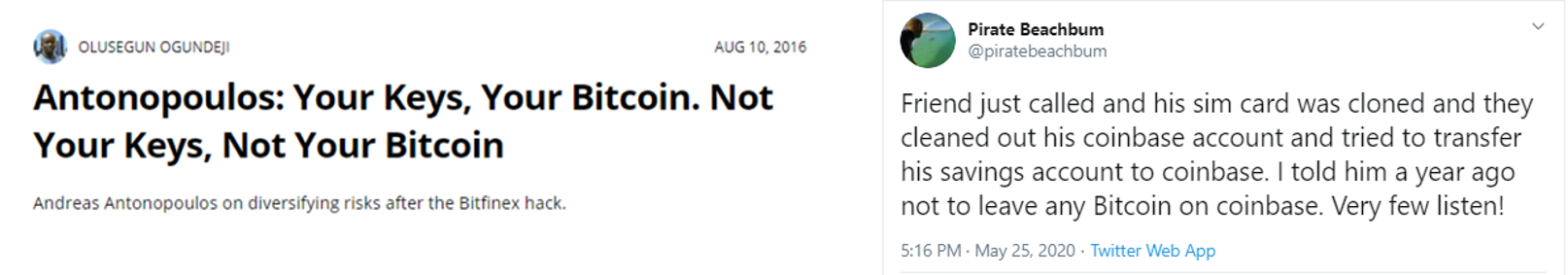

| Company or service provider error | – Mt. Gox hack – stolen bitcoin – Bitfinex hack – stolen bitcoin – Binance hack – stolen bitcoin – BlockFi hack – stolen personal information – Hardware wallet vulnerabilities | – Errors owned by responsible parties – No bailouts – Accountability eliminates moral hazard – Companies adapt or fail – Bitcoin wins, strengthens |

| Individual user error | – Individual exchange accounts getting hacked – Accounts being frozen or terminated – SIM Swaps – Bitcoin wallets being lost or stolen – Forgetting passphrases to private keys – Malicious browser extensions or malware | – Errors owned by responsible parties – No bailouts – Accountability eliminates moral hazard – Individuals adapt or lose money – Bitcoin wins, strengthens |

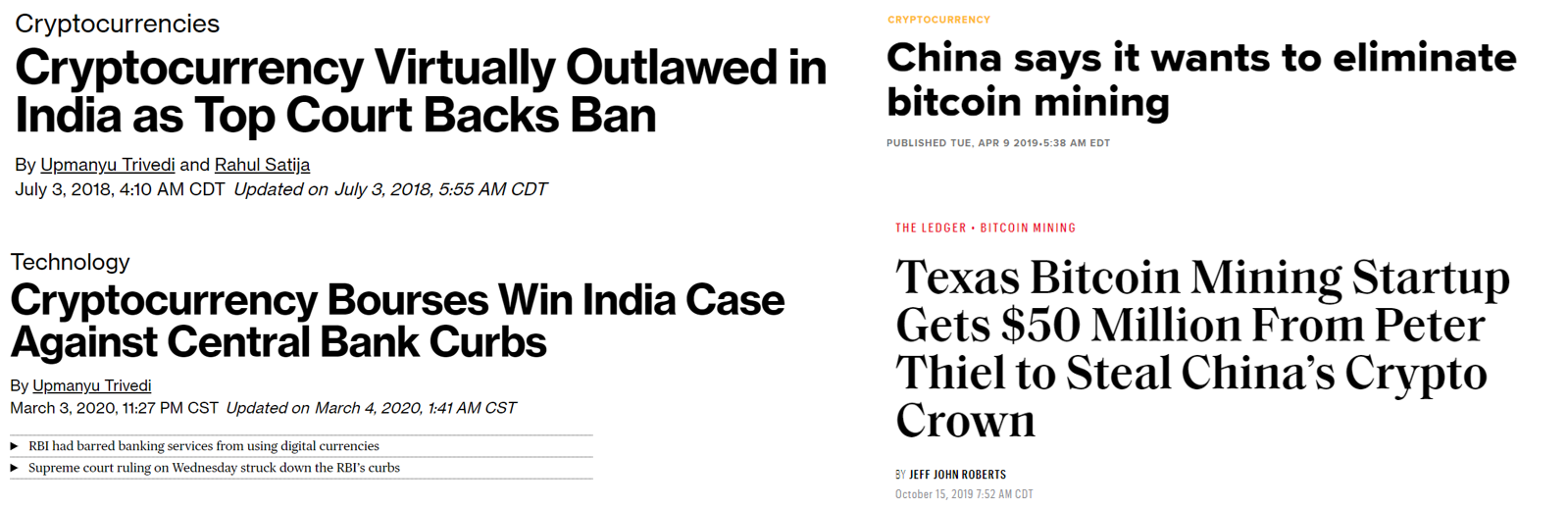

Each form of stress hardens the bitcoin network and often for different reasons. Whenever governments take action in an attempt to ban bitcoin or otherwise restrict its use, the network continues to function unperturbed. China and India, countries with a combined population of 2.7 billion people, have both taken material actions to curb the spread of bitcoin. Despite this, the network as a whole continues to function without flaw, and bitcoin continues to be used in both countries. After the RBI (Central Bank of India) restricted the ability for banks to service bitcoin or cryptocurrency-related companies, the Supreme Court in India ultimately overturned the ban as unconstitutional. It sets precedent in more ways than one. First, that the central bank was overruled; second, that the ban was ultimately unsuccessful as people continued to find ways to access bitcoin; and third, that despite these actions, the network was unphased. Separately, China has taken measures to restrict the ability of exchanges to facilitate bitcoin trading and has expressed an interest in eliminating bitcoin mining. Similar to India, people continue to use bitcoin in China and the bitcoin network has been undeterred. Naturally, as government regulation in China has become more restrictive, miners have begun to look to more stable jurisdictions. Bitcoin mining in the United States (among other regions) continues to grow, and Peter Thiel recently backed a startup that is building out mining operations in West Texas. Regardless of the threat, bitcoin exists beyond countries (and governments). The network adapts to jurisdictional risks and continues to function without interruption. As network participants observe the failed attempts to inhibit bitcoin’s growth and witness how it adapts, bitcoin does not merely remain static; it actually becomes more resilient through this process by routing around and immunizing each passing threat.

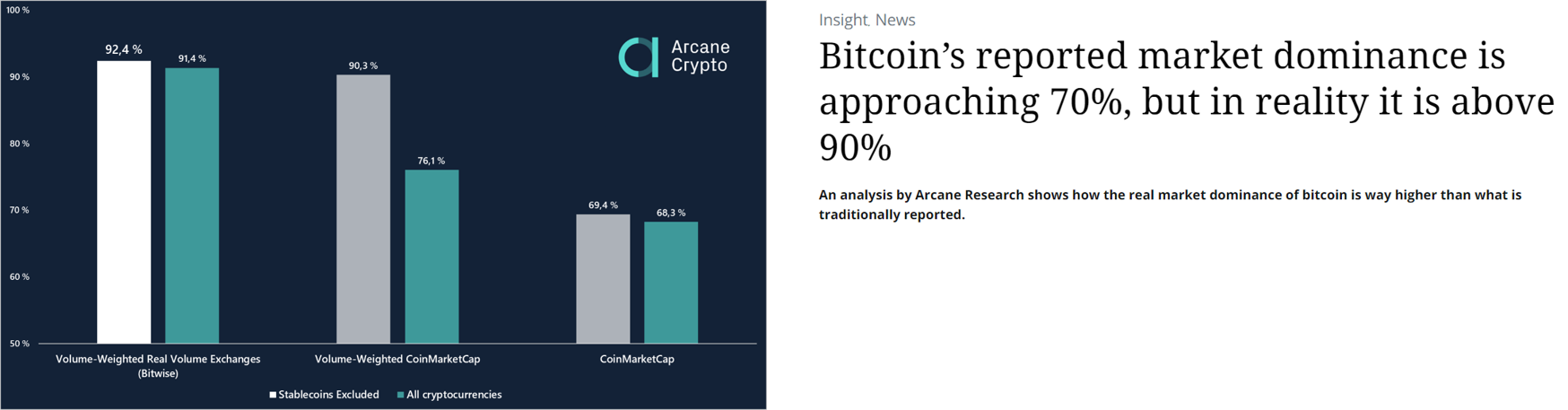

An entirely different type of stress comes in the form of competing cryptocurrencies. Since bitcoin was launched in 2009, there have been no fewer than a thousand competing digital currencies. While often (but not always) espousing different purposes and “use cases,” in each instance, every single one has in reality been competing with bitcoin as money. In many cases, the creators do in fact call out perceived flaws in bitcoin and how a particular competing protocol intends to improve on its “limitations”. Despite thousands of competitors, bitcoin accounts for ~70% of all cryptocurrencies in terms of market value, and when adjusted for liquidity, the estimate is closer to ~90%. Whereas one currency accounts for 70% to 90% of value depending on the metric, thousands of competing cryptocurrencies account for 10% to 30%. That is the market distinguishing between bitcoin and the field. Competition is inherently good for bitcoin. Not only does each attempt to create a better bitcoin fail, the repeated failures actually inform market participants that there is something which distinguishes bitcoin from the rest of the field. Even if the what or why is not immediately self-evident, the market provides useful information. Bitcoin does not just withstand the competition; it beats the competition. While bitcoin cannot be copied, that fact is more easily learned through market functions and market tests than any amount of reason and logic. Through the failed experiences of competing currencies, bitcoin accumulates more human capital, and the network grows as a direct result. If bitcoin were never tested or challenged, it would not have the opportunity to benefit from stress. That it is constantly challenged and stressed through competition creates a more resilient network and a larger holder base.

An entirely different type of stress comes in the form of competing cryptocurrencies. Since bitcoin was launched in 2009, there have been no fewer than a thousand competing digital currencies. While often (but not always) espousing different purposes and “use cases,” in each instance, every single one has in reality been competing with bitcoin as money. In many cases, the creators do in fact call out perceived flaws in bitcoin and how a particular competing protocol intends to improve on its “limitations”. Despite thousands of competitors, bitcoin accounts for ~70% of all cryptocurrencies in terms of market value, and when adjusted for liquidity, the estimate is closer to ~90%. Whereas one currency accounts for 70% to 90% of value depending on the metric, thousands of competing cryptocurrencies account for 10% to 30%. That is the market distinguishing between bitcoin and the field. Competition is inherently good for bitcoin. Not only does each attempt to create a better bitcoin fail, the repeated failures actually inform market participants that there is something which distinguishes bitcoin from the rest of the field. Even if the what or why is not immediately self-evident, the market provides useful information. Bitcoin does not just withstand the competition; it beats the competition. While bitcoin cannot be copied, that fact is more easily learned through market functions and market tests than any amount of reason and logic. Through the failed experiences of competing currencies, bitcoin accumulates more human capital, and the network grows as a direct result. If bitcoin were never tested or challenged, it would not have the opportunity to benefit from stress. That it is constantly challenged and stressed through competition creates a more resilient network and a larger holder base.

While stress exposed to the network from external threats creates positive externalities, bitcoin also benefits from more regular and consistent stressors from within the network, typically arising in the form of malicious attacks or unintentional error. Attacks aimed at participants within the network, whether companies or individuals, occur practically at a constant clip. Each participant is maximally and independently responsible for the security of their bitcoin holdings, whether choosing to trust a third-party or whether taking on that responsibility directly. Many of the largest exchanges in the world have been hacked as have many individuals within the network. For those that have not, the threat always exists. As participants are compromised, hacked or otherwise have access to bitcoin restricted, it does not impact the functioning of the network, but like all stressors, the attack vectors directly cause the network to adapt and become stronger.

With numerous critical exchange failures, market participants increasingly shift to taking on the responsibility of holding their own bitcoin, independent from third-party service providers. The same is true in response to individual accounts at exchanges getting hacked. Not dissimilarly, as threats are identified for those that secure their own bitcoin, more secure wallets are developed and users opt toward more secure ways to safely secure their bitcoin by reducing or eliminating single points of failure. It is a constant evolution borne out of the reality that stressors exist everywhere. The network is not exposed to any critical failures because the entire network iterates through trial and error around the clock, with free competition and endless market opportunity incentivizing innovation. And, with each failure, everyone is on their own and personally accountable. The incentive structure dictates that everyone constantly seeks out better ways of securing bitcoin. Through this process of stress, the network very naturally and organically strengthens.

Similar to the benefit provided by consistent stressors, volatility tangibly builds the immunity of the system. While it is often lamented as a critical flaw, volatility is really a feature and not a bug. Volatility is price discovery and in bitcoin, it is unceasing and uninterrupted. There are no Fed market operations to rescue investors, nor are there circuit breakers. Everyone is individually responsible for managing volatility and if caught offsides, no one is there to offer bailouts. Because there are no bailouts, moral hazard is eliminated network-wide. Bitcoin may be volatile, but in a world without bailouts, the market function of price discovery is far more true because it cannot be directly manipulated by external forces. It is akin to a child touching a hot stove; that mistake will likely not be made more than once, and it is through experience that market participants quickly learn how unforgiving the volatility can be. And, should the lesson not be learned, the individual is sacrificed for the benefit of the whole. There is no “too big to fail” in bitcoin. Ultimately, price communicates information and all market participants observe the market forces independently, each adapting or individually paying the price.

But information is not just communicated through price volatility. Volatility is also how bitcoin gets distributed and how the network becomes further decentralized. Every time a bitcoin is sold, someone else is buying. Consistently over time, the ownership of the network becomes more decentralized, and this occurs most acutely in bouts of volatility. In very tangible ways, the volatility strengthens bitcoin by decentralizing it and reinforcing that while tulips may die, bitcoin never does. As the network becomes more decentralized, it similarly becomes more censorship resistant and each individual within the network holds a smaller and smaller share of the currency (on average) resulting in a dynamic in which, over time, price is less exposed to the preferences of a few large holders. It is not to say that there do not remain large holders that can singularly influence price and volatility, but as a directional trend, the impact of any individual on price diminishes over time and often directly through the distributive function of volatility itself.

And when network participants, individually and as a whole, observe that bitcoin survives, even after extreme downside volatility, that mere fact strengthens confidence in the network. At some price, individuals were willing to step in and catch the falling knife. Through these episodes, bitcoin accumulates more human capital. The weak hands are shaken out and the strongest hands always survive (often in the form of new holders), causing the network to become more resilient and not merely remaining static or simply absorbing the disruption. Bitcoin actually feeds on the chaos. In the end, near-term volatility directly contributes to long-term stability. By maintaining a fixed supply with highly variable present demand, the market performs price discovery 24 hours a day, 7 days a week. It is the intermittent stress that trains and hardens all individual owners and which prevents the network from being exposed to systemic risk. All while the opposite is true of fiat currencies. Central banks manage currencies to maintain short-term stability but ultimately, by suppressing volatility, imbalances accumulate below the surface leading to fragility and greater systemic shocks in the long-term, as has been witnessed with increasing regularity over the last two decades. The contrast between the two competing systems could not be more extreme and it is volatility in bitcoin that communicates information with the least distortion, and without which long-term stability would not be possible.

“Complex systems that have artificially suppressed volatility tend to become extremely fragile, while at the same time exhibiting no visible risks […] Such environments eventually experience massive blowups, catching everyone off-guard and undoing years of stability”

“Variation is information. When there is no variation, there is no information […] there is no freedom without noise—and no stability without volatility.” – Taleb & Blythe, Foreign Affairs, May/June 2011 Issue

“Many of the greatest things man has achieved are the result not of consciously directed thought, and still less the product of a deliberately coordinated effort of many individuals, but of a process in which the individual plays a part which he can never fully understand. They are greater than any individual precisely because they result from the combination of knowledge more extensive than a single mind can master.” – Hayek, The Counter-Revolution of Science

Lastly, randomness. While most people recognize that there is intelligent design in bitcoin’s foundation, what is often missed is the randomness through which it evolved and that what it became (money) was largely a function of that randomness. Lightning was caught in a bottle; it was a result of thousands of people making thousands of independent decisions very early on. But the process also continues to this day. From cryptographers and developers contributing time and energy, to companies and investors building infrastructure, and to users just wanting to find a better way to store value. If the reset button was hit going all the way back to 2008 when the bitcoin white paper was released, and the same initial code was released, placing the same people in the same rooms, bitcoin would very likely not be what it is today. It may be “better” or “worse,” but ultimately it was and continues to be a product of randomness. It is not the product of consciously directed thought, and it expands beyond the resources of individual minds because of that fact. For those that perceive flaws in bitcoin and have (or had) ideas of how to make a better bitcoin, the intelligence of bitcoin’s design is often observed and acknowledged. Design can be copied and individual features can be changed out, but randomness cannot be replicated.

One week after bitcoin was launched, Hal Finney famously tweeted to the world that he was “running bitcoin.” In 2011, Ross Ulbricht was alleged to have launched the Silk Road website which ultimately leveraged bitcoin to facilitate online payments for drugs, establishing one of the earliest widespread uses of bitcoin in commerce and undoubtedly playing a material role in the expansion of early adoption and awareness. In 2014, Mt. Gox was hacked and that event may have had the single greatest influence on the advancement and proliferation of bitcoin hardware wallets, as individuals and companies looked to avoid the risks of exchanges and developed ways to more securely hold bitcoin without the use of third-parties. In 2017, after a bitcoin service provider drew the ire of Nicolas Dorier, he set out to build a product that would obsolete that provider and service, spawning one of the most exciting open source projects within bitcoin, BTCPay Server. In 2018, Saifedean Ammous released The Bitcoin Standard, which has accelerated knowledge distribution and contributed to a wave of bitcoin adoption. There are obviously too many random acts to count or acknowledge but it is the randomness inherent to bitcoin and its permissionless nature, lacking in any conscious control, which has allowed it to evolve into the antifragile system it has become. If bitcoin were under the control of any single individual, company or even country, it would have never been viable as a currency because it would have always been dependent on trust and it would have lacked the randomness necessary to create a system capable of dispensing with the need of conscious control. Randomness is irreplicable and the foundation of bitcoin was built on it.

In aggregate, as a currency and economic system, bitcoin benefits from disorder. It is the constant exposure to stressors, volatility and randomness which causes bitcoin to evolve, adapt and ultimately to become stronger in near-uniform fashion and in a way that would not be possible in the absence of disorder. Bitcoin may still be young, but it is not temporary. It was released into the wild, and what has spawned is a system that cannot be controlled or shut down. It’s both everywhere and nowhere, all at the same time. It is like an elusive ghost. Its decentralized and permissionless state eliminates single points of failure and drives innovation, ultimately ensuring both its survival and a constant strengthening of its immune system as a function of time, trial and error. Bitcoin is beyond resilient. The resilient resists shocks and stays the same; bitcoin gets better. While it is easy to fall into a trap, believing bitcoin to be untested, unproven and not permanent, it is precisely the opposite. Bitcoin has been constantly tested for going on 12 years, each time proving to be up to the challenge and emerging from each test in a stronger state. At the end of the day, bitcoin is more permanent than it is risky because of antifragility. As a currency system, it manages to extend the utilization of resources beyond the control of deliberately coordinated effort, entirely dispensing with the need of conscious control all together. Bitcoin is the antifragile competitor to the inherently fragile legacy monetary system. On the one hand, a legacy system crippled by moral hazard, dependent on trust and centralized control. One that accumulates imbalance and fragility when exposed to stress and disorder, principally as a function of trillions in bailouts with each passing shock, which only further weakens its immune system. That compared to bitcoin which is a system devoid of moral hazard and which operates flawlessly on a decentralized basis, without trust and without bailouts. It eliminates imbalance and sources of fragility as a constant process, further strengthening the currency system as a whole and as a function of time. What doesn’t kill the legacy monetary system only makes it weaker. What doesn’t kill bitcoin only makes it stronger.

“Antifragility is beyond resilience or robustness. The resilient resists shocks and stays the same;

the antifragile gets better.” – Nassim Taleb, Antifragile

“But those who clamor for “conscious direction”—and who cannot believe that anything which has evolved without design (and even without our understanding it) should solve problems which we should not be able to solve consciously—should remember this: The problem is precisely how to extend the span of our utilization of resources beyond the span of the control of any one mind; and therefore, how to dispense with the need of conscious control, and how to provide inducements which will make the individuals do the desirable things without anyone having to tell them what to do.” – Hayek, The Use of Knowledge in Society.

Views presented are expressly my own and not those of Unchained Capital or my colleagues. Thanks to Will Cole and Phil Geiger for reviewing and for providing valuable feedback.

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

Ted Stevenot, Stephen HallWhen Satoshi Nakamoto created bitcoin, he established in its code a fixed number of bitcoin that will ever exist. Since…

Ted StevenotOriginally published in Parker’s dedicated Gradually, Then Suddenly publication. Bitcoin is often described as a hedge, or more specifically, a…

Parker Lewis